Region:Asia

Author(s):Geetanshi

Product Code:KRAA3370

Pages:93

Published On:January 2026

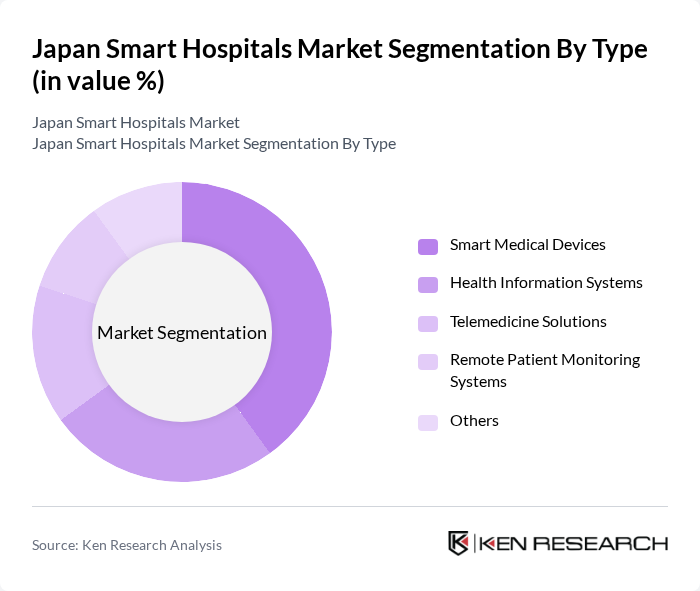

By Type:The market is segmented into various types, including Smart Medical Devices, Health Information Systems, Telemedicine Solutions, Remote Patient Monitoring Systems, Smart Infrastructure, and Others. Among these, Smart Medical Devices are leading the market due to their critical role in enhancing patient care and operational efficiency. The increasing demand for connected devices that facilitate real-time monitoring and data collection is driving this segment's growth. Health Information Systems also play a significant role, as they streamline hospital operations and improve patient data management.

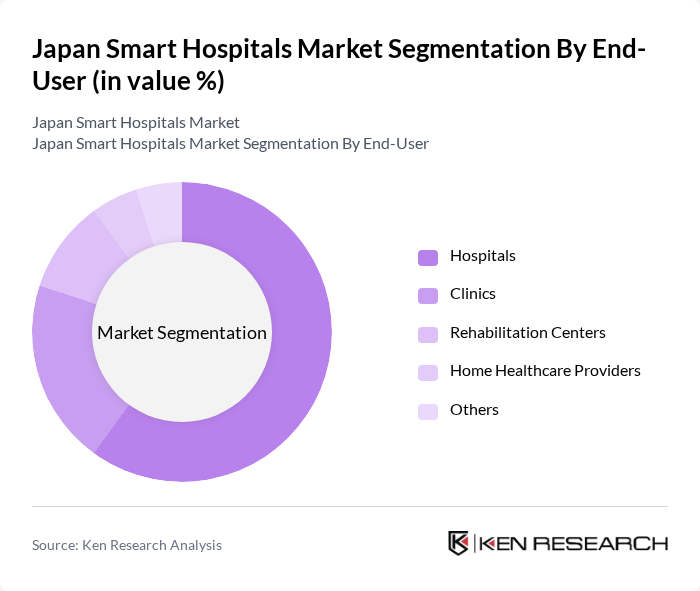

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Rehabilitation Centers, and Others. Hospitals dominate this segment, driven by the need for advanced healthcare solutions to manage increasing patient loads and improve service delivery. The trend towards integrated care models and the growing emphasis on patient-centric services are further propelling the adoption of smart technologies in hospitals. Clinics and Home Healthcare Providers are also witnessing significant growth as they adopt telemedicine and remote monitoring solutions.

The Japan Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujifilm Holdings Corporation, Hitachi, Ltd., NEC Corporation, Philips Japan, Ltd., Siemens Healthineers, Toshiba Medical Systems Corporation, Canon Medical Systems Corporation, GE Healthcare Japan, Medtronic Japan, Johnson & Johnson Japan, Abbott Laboratories Japan, Cerner Corporation, Allscripts Healthcare Solutions, Oracle Corporation, Accenture Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart hospitals market in Japan appears promising, driven by technological advancements and supportive government policies. As the healthcare sector continues to embrace digital transformation, the integration of AI and IoT will enhance patient care and operational efficiency. Additionally, the expansion of telemedicine and personalized medicine will cater to the evolving needs of patients, particularly the aging population. These trends indicate a robust growth trajectory for smart hospitals, positioning them as essential components of Japan's healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Medical Devices Health Information Systems Telemedicine Solutions Remote Patient Monitoring Systems Smart Infrastructure Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Rehabilitation Centers Others |

| By Service Type | Inpatient Services Outpatient Services Emergency Services Diagnostic Services Others |

| By Technology | Artificial Intelligence Internet of Things (IoT) Blockchain Technology Cloud Computing Others |

| By Application | Patient Management Workflow Management Data Management Financial Management Others |

| By Region | Kanto Region Kansai Region Chubu Region Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administration Insights | 100 | Hospital Administrators, Chief Information Officers |

| Healthcare Technology Adoption | 80 | IT Managers, Technology Officers |

| Patient Experience and Engagement | 70 | Nurses, Patient Care Coordinators |

| Telemedicine Implementation | 60 | Telehealth Coordinators, Medical Directors |

| IoT and AI in Healthcare | 90 | Healthcare Data Analysts, Biomedical Engineers |

The Japan Smart Hospitals Market is valued at approximately USD 8 billion, driven by the increasing adoption of advanced healthcare technologies and the integration of IoT and AI in medical practices.