Region:Middle East

Author(s):Rebecca

Product Code:KRAB2267

Pages:92

Published On:January 2026

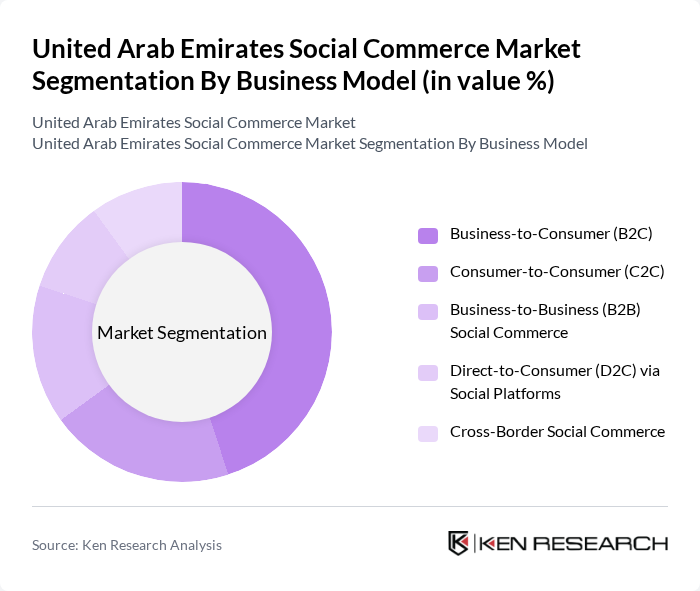

By Business Model:

The business model segmentation of the United Arab Emirates Social Commerce Market includes various subsegments such as Business-to-Consumer (B2C), Consumer-to-Consumer (C2C), Business-to-Business (B2B) Social Commerce, Direct-to-Consumer (D2C) via Social Platforms, and Cross-Border Social Commerce. Among these, the B2C model is the most dominant, driven by the increasing number of consumers shopping online through social media platforms and integrated storefronts on major marketplaces. The convenience of purchasing directly from social media ads, live streams, creator storefronts, and influencer recommendations has significantly influenced consumer behavior, leading to a surge in B2C transactions as brands use social channels as primary sales and discovery tools.

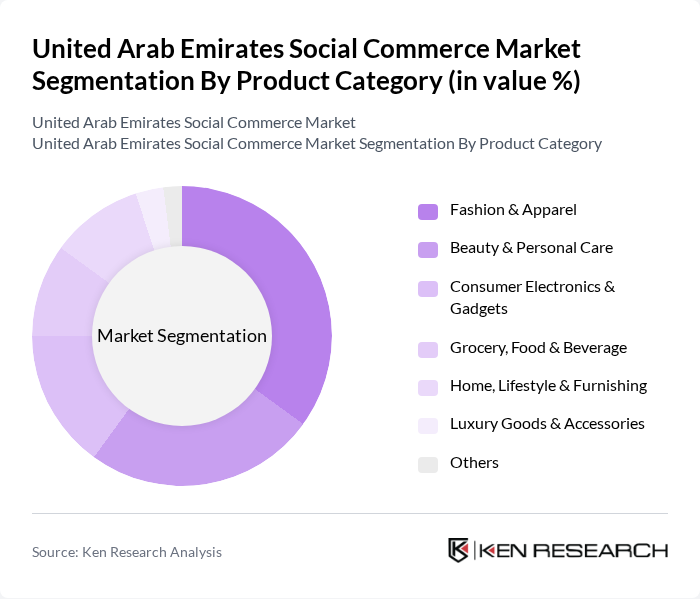

By Product Category:

The product category segmentation encompasses Fashion & Apparel, Beauty & Personal Care, Consumer Electronics & Gadgets, Grocery, Food & Beverage, Home, Lifestyle & Furnishing, Luxury Goods & Accessories, and Others. The Fashion & Apparel segment leads the market, reflecting the strong role of social platforms in product discovery, outfit inspiration, and brand storytelling for clothing, footwear, and accessories. The segment is fueled by the growing trend of online shopping, the influence of regional and global influencers, and the use of visual and short-form video content, which encourage consumers to browse and purchase fashion items directly through shoppable posts, live sessions, and creator-led campaigns on social media platforms.

The United Arab Emirates Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.ae, Noon, Namshi, Ounass, Carrefour UAE, Dubizzle, Talabat UAE, Deliveroo UAE, InstaShop, Mumzworld, Sharaf DG Online, Al-Futtaim Group, Landmark Group, Chalhoub Group, Al Tayer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of social commerce in the UAE appears promising, driven by technological advancements and changing consumer behaviors. As more brands adopt innovative marketing strategies, including augmented reality and personalized shopping experiences, the sector is likely to witness significant growth. Additionally, the increasing integration of payment solutions will enhance consumer confidence, making online transactions more secure and convenient. Overall, the social commerce landscape is set to evolve, aligning with global trends while catering to local preferences.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Business-to-Consumer (B2C) Consumer-to-Consumer (C2C) Business-to-Business (B2B) Social Commerce Direct-to-Consumer (D2C) via Social Platforms Cross-Border Social Commerce |

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics & Gadgets Grocery, Food & Beverage Home, Lifestyle & Furnishing Luxury Goods & Accessories Others |

| By Buyer Type | Individual Consumers Micro & Small Sellers / Home Businesses SMEs & Local Brands Large Enterprises & Retailers |

| By Social Media / Commerce Format | In-App Shops (e.g., Instagram Shop, Facebook Shop) Live Commerce & Live Streaming Social Marketplaces & Groups Messaging & Chat-Commerce (e.g., WhatsApp, Messenger) Creator Stores & Influencer-Led Shops |

| By Payment Method | Credit / Debit Cards Digital Wallets & Super Apps Buy Now Pay Later (BNPL) Bank Transfers Cash on Delivery |

| By City Tier | Dubai Abu Dhabi Sharjah & Northern Emirates Other Cities |

| By Customer Journey Stage | Discovery & Content-Led Browsing Consideration & Social Proof (Ratings / Reviews) In-Platform Checkout Post-Purchase Engagement & Loyalty |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 150 | Online Shoppers, Social Media Users |

| Small Business Utilization of Social Platforms | 100 | Small Business Owners, Marketing Managers |

| Influencer Marketing Impact | 80 | Social Media Influencers, Brand Managers |

| Trends in Social Media Advertising | 120 | Digital Marketing Professionals, Ad Agency Executives |

| Consumer Trust and Security Concerns | 90 | General Consumers, E-commerce Users |

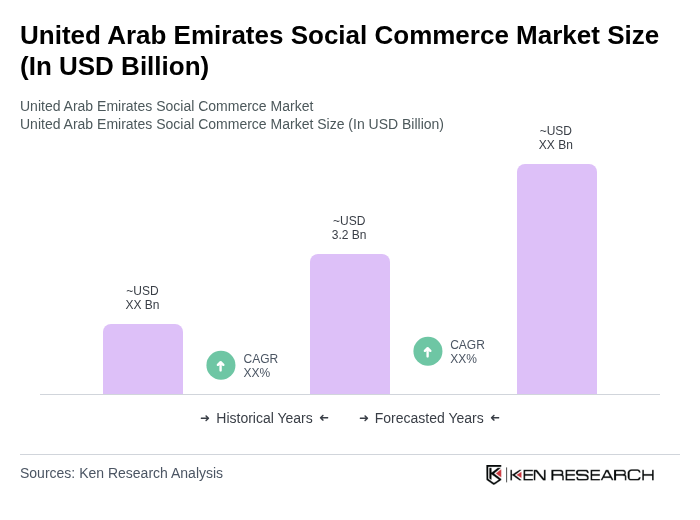

The United Arab Emirates Social Commerce Market is valued at approximately USD 3.2 billion, with projections indicating it could reach USD 6.41 billion by 2030. This growth is driven by increased social media usage and changing consumer shopping behaviors.